Those with a vested interest in the Legal & General (LSE:LGEN) share price probably don’t pay too much attention to international accounting standards. But if they did, the most observant would see that the company has recently adopted new rules when it comes to the reporting of the profitability of insurance contracts, including annuities and pensions.

The financial services group now recognises profits as it delivers the services, rather than when it receives the premiums. It therefore has to make an assessment as to the timing of cash flows over the lifetime of its policies.

It’s important to note that this doesn’t affect the overall value of these contracts. Instead, earnings are moved from one accounting period to another.

Should you invest £1,000 in Ig Group Holdings right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Ig Group Holdings made the list?

However, it does mean that the company’s in a position to report the estimated value of these earnings streams. And at 30 June, it said its so-called ‘store of profit’ from its insurance contracts was £14.5bn.

Why is this significant?

This is useful because share prices – in theory — are supposed to reflect the present value of future cash flows.

Legal & General’s current (22 November) market cap is £12.9bn.

If it was to sell off its insurance and retirement divisions, these would (on paper) be worth more than the entire group.

But it gets better.

The store of profit doesn’t reflect the contribution of its capital or investment management businesses. These contributed 37.7% to adjusted operating profit during the year ended 31 December 2023 (FY23).

However, based on the anticipated future performance of its retirement and insurance divisions alone, the Legal & General share price is — in my opinion — at least 11% undervalued.

Healthy dividends

And there’s another reason why I like the stock.

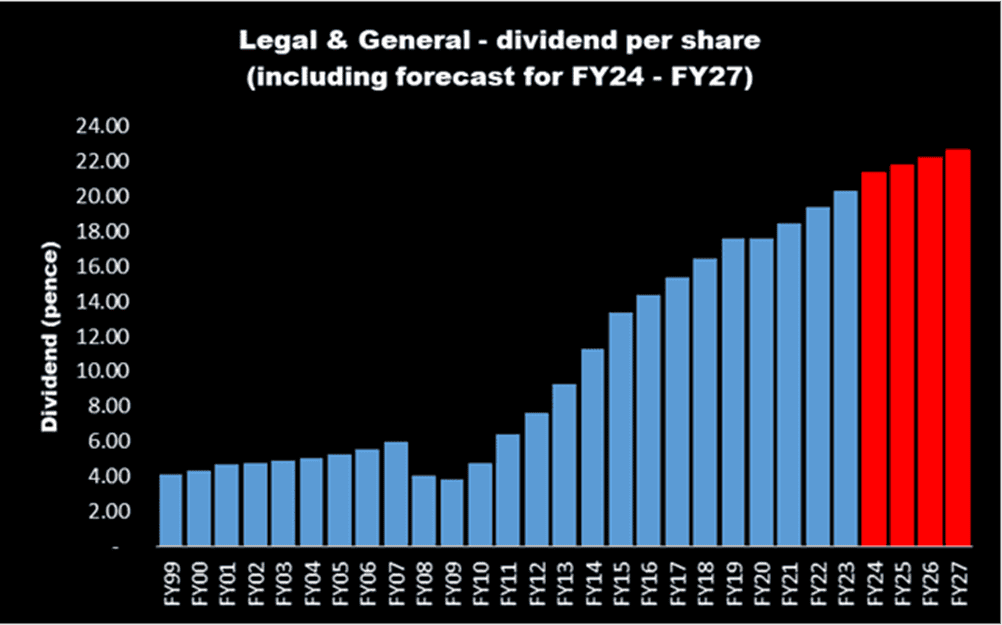

The company has a long track record of increasing its payouts to shareholders.

For FY23, it declared a dividend of 20.34p. It’s promised to increase this by 5% in 2024. And by 2% a year from FY25-FY27.

Based on its expected return in 2024 (21.36p), the stock’s presently yielding an amazing 9.7%. The average for the FTSE 100 is 3.8%.

Of course, dividends are never guaranteed.

What does this all mean?

Despite this impressive yield, the company’s share price has stagnated over the past year. Since November 2023, it’s down 3%.

And it’s fallen 15% from its 52-week high, achieved in March.

I suspect this is because Legal & General derives the majority of its revenue from the UK — 82.5% in FY23 — where there’s little good news to report at the moment.

The economy shrank 0.1% in September. In October, both inflation and government borrowing exceeded expectations. And following the Budget, most economists expect interest rates to remain higher for longer.

The company’s earnings are also affected by the stock market because, at 31 December 2023, it had £186bn of equities on its balance sheet. This means its profits can fluctuate during periods of market volatility.

However, despite these potential challenges, I’m going to keep the stock on my watchlist for when I next have some spare cash.

The group has an enormous pipeline of corporate pension schemes that it hopes to acquire, which should help to support the generous dividend. That’s particularly appealing to an income investor like me.